We work across sectors and take an integrated view of impact during the design of interventions in:

Agriculture

Agriculture Renewable Energy

Renewable Energy Circular Economy

Circular Economy Health

Health Governance

Governance Gender

Gender Education

Education Skilling

Skilling Employment

EmploymentCapital seeking risk-adjusted returns that can be unlocked at scale with appropriate de-risking in areas where markets can work

Flexible, risk absorbing and patient capital willing to take below-market returns in order to generate the benefits of blending

Using scarce non-return seeking funds from government and charity to drive accountability of development spending

(Leverage)

(Cost of Capital)

(Outcomes)

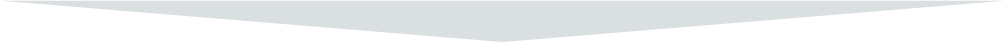

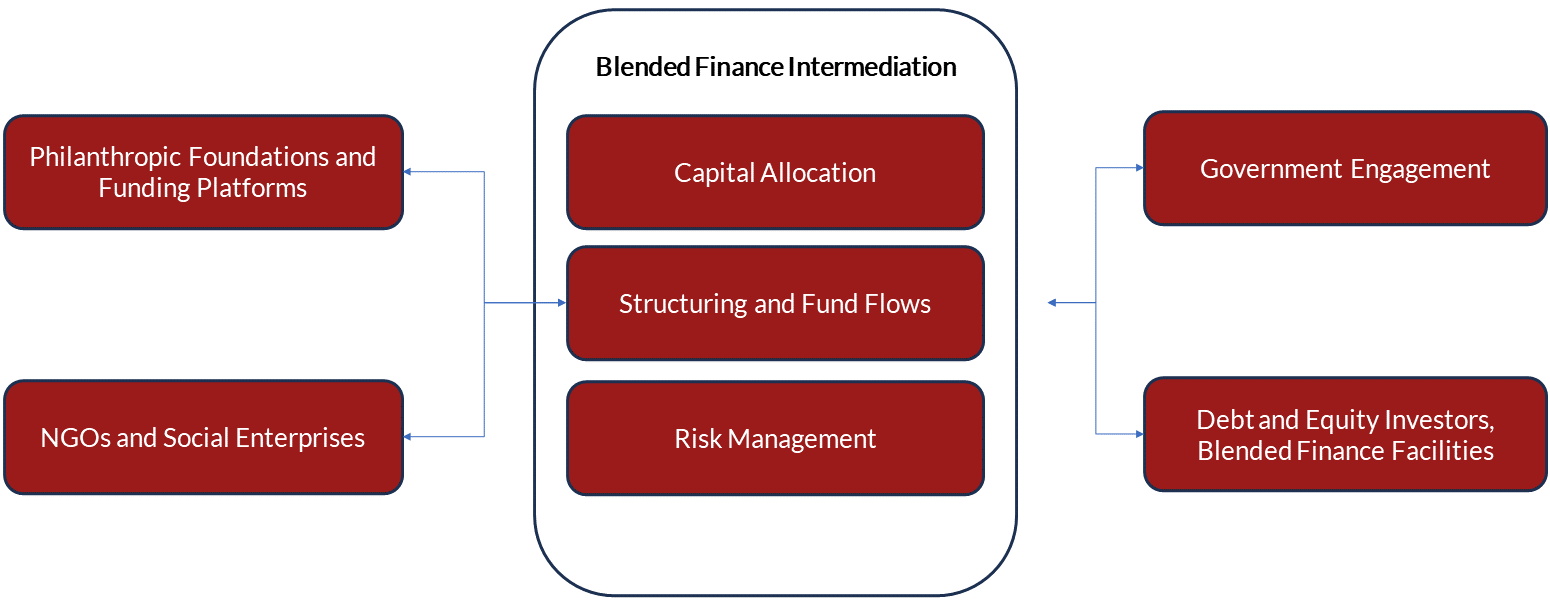

D&A helps develop innovative financing solutions for sustainable development across the spectrum of capital for both supply-side (Foundations, HNIs, CSRs, Banks, VCs, Impact Funds, NBFCs), and demand-side stakeholders.

Education & EdTech

Teaching at leading universities like Ashoka University, ISDM & AUD

Designing e-learning modules on innovative finance and case studies on leading impact funds

Sharing open-source digital content across our channels including Blog, Newsletters and YouTube Videos

Intro to Innovative Finance,

Undergrad course (Spring 2022)

Social innovation, Entrepreneurship &

Venture Capital Investing

MBA course (Spring 2022)

Intro to Impact Investment,

Post Grad Certificate (Spring

2022)

Introduction to Sustainable and

Green Finance & ESG

B-Tech in Climate Science (Fall

2022)

Policy Engagement

Developing policy proposals on key regulatory issues to unlock innovative finance, support in creating policy sandboxes and supporting central agencies in designing government backed impact finance interventions

Facilitate dialogs and partnerships for unlocking global development finance with multilateral agencies (UN, WB) and in relevant global forums (G20)

Knowledge and advocacy on blended and outcome-based financing for state governments and large-scale government programs.

Support on listing new instruments on the Social Stock Exchange

Advisory to UN DESA on the SDG Summit, GISD Alliance and the Financing for Development Dialogue

Engaging with leading Industry Associations such as IIC, AVPN and GSG on innovative finance

Capacity & Convening

Capacity building for not-for-profits, investors and policymakers through workshops, trainings, and resources on how to leveraging innovative finance.

Convening platforms to connect key stakeholders on innovative finance, with a focus on bringing new investors to the table and engaging them in a dialogue with relevant policymakers

Convening India’s first Outcome- financing summit, Parinaam.

Conducting learning sessions for NGOs and creating digital training resources for example BlendEd video explainer series

Capacity building of government officials on outcome based and blended finance.

Intro to Innovative Finance,

Undergrad course (Spring 2022)

Social innovation, Entrepreneurship &

Venture Capital Investing

MBA course (Spring 2022)

Intro to Impact Investment,

Post Grad Certificate (Spring

2022)

Introduction to Sustainable and

Green Finance & ESG

B-Tech in Climate Science (Fall

2022)

Knowledge and advocacy on blended and outcome-based financing for state governments and large-scale government programs.

Support on listing new instruments on the Social Stock Exchange

Advisory to UN DESA on the SDG Summit, GISD Alliance and the Financing for Development Dialogue

Engaging with leading Industry Associations such as IIC, AVPN and GSG on innovative finance

Convening India’s first Outcome- financing summit, Parinaam.

Conducting learning sessions for NGOs and creating digital training resources for example BlendEd video explainer series

Capacity building of government officials on outcome based and blended finance.